How to Choose Bitfinex Margin Funding Rate

By writing this article, I want to dive deeper into techniques of how to choose Bitfinex margin funding rate. As the market tends to change very quickly, there are no general instructions for all cases of how to do this. Therefore, I'll describe few rules which I follow in certain market conditions. On the way, I will also clarify why interest rate changes and what determines its trend.

This article is a supplement to my former article "How to Setup Bitfinex Margin Funding for Passive Income", so in case you are not familiar with Bitfinex margin funding, I recommend reading it.

Why interest rate is used to change?

Margin funding interest rate, as well as Bitcoin price, depends on supply and demand. If there are more margin funding offers, then interest rate tends to fall, if there are more requests –interest rate tends to go up.

This movement directly relates to Bitcoin price movement. Let's say that Bitcoin price goes up, what means that there are more buyers than sellers. Some of the traders trade on the margins and they borrow dollars to buy Bitcoins. So as a result, they form a great demand of the USD and hence, USD margin funding interest rate is more likely to go up. On the contrary, when Bitcoin price falls down - nobody wants to borrow dollars, but instead, they borrow Bitcoins and put them into short positions. So in this case USD margin funding rate falls down, but the BTC margin funding rate goes up.

How to catch the trend of margin funding interest rate?

The simplest way to determine margin funding trend is to check margin funding interest rate historical chart. By using this chart you can anticipate further direction of the trend and make relevant decisions. You can also use a few simple indicators to do this.

The first indicator is a Bitcoin price trend, which can be easily determined by looking at a historical price action chart. If Bitcoin price increases, then you can anticipate that USD margin funding rates are more likely to go up as well.

Another indicator is margin funding depth chart (bids and offers). If there is a big spread between bids and offers, then you can anticipate a short term interest rate movement direction. If margin funding bid rates are higher than offer rates, then you can anticipate the increase of margin funding interest rates. And if margin funding bid rates are lower than offer rates, then vice versa - margin funding rates is more likely to fall down.

Rules, which I follow

The main thing to consider when placing a USD margin funding offers is the trend of interest rate movement. Depending on market conditions and current trends, you have to choose margin funding period and interest rate, which will bring the highest return. Basically the trend can go up, down, or remain stable. So let's review these options.

I. Rules to follow when margin funding rate trend goes up

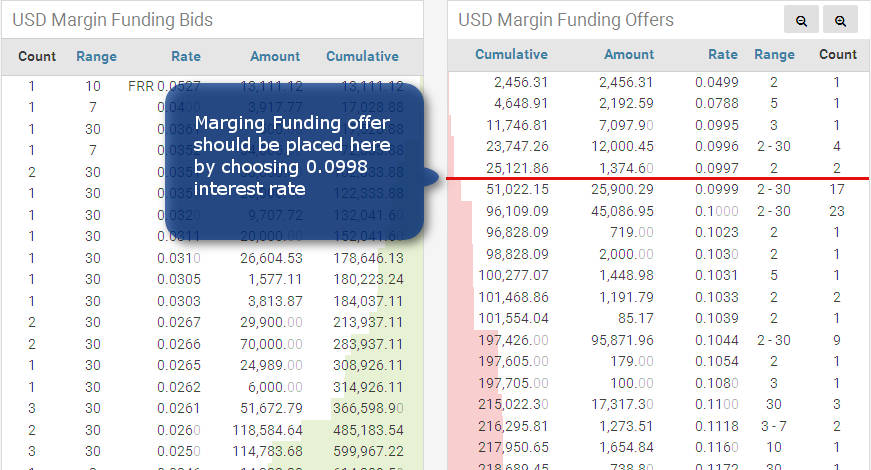

When margin funding USD interest rate is increasing, the main idea is to catch it and to lend money at the most recent and hence highest rates. You can achieve that easily by choosing short lending period (2-5 days) and by following 50K rule when choosing interest rate. That is, you must look at margin funding offers table and place your offer at the rate nearest to the 50K mark on the cumulative amount column. Look at the picture below, to see what I mean.

The idea of 50K rule is to support interest rate so it won't be getting lower. There are many traders who want their offers to be taken as soon as possible so they place them on top of other offers, hence decreasing margin funding interest rate. But you should not be worrying about them as we are talking about the up trending market, which means that your offer will be taken very quickly.

II. Rules to follow when margin funding rate falls down

When interest rates are falling, the aim is to hold your investments at high interest rates as long as possible. To achieve that, you should choose a long lending period (up to 30 days) thus scoping interest rate for your investment.

Although scoping of interest rate sounds very good, nobody wants to have a loan for a long time with a high interest rate. Such loans may be returned very quickly and you can't do anything about it. So is there a trick to avoid that? Well, it is sad, but no. However, there is a tip of how to lower the early repay probability. Read about this tip on my next blogpost "Bitfinex Margin Funding Depth Chart to the Rescue".

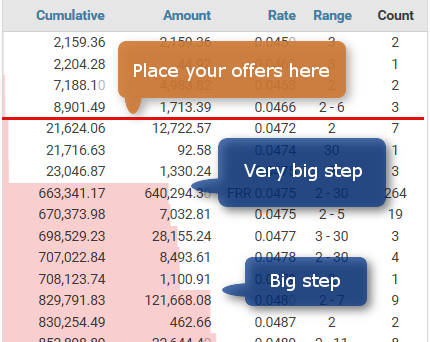

When it comes to choosing interest rate, I follow a few rules. The first is 20K rule. It is the same as 50K rule mentioned above, but the rate should be chosen at the 20K mark instead of 50K. Again, the aim is to support margin funding interest rate and as it is used to fluctuate a bit up and down, the 20K limit is rather safe in down trending market conditions and your offers should be taken rather quickly.

Another very important rule - avoid the big steps in margin funding interest rate depth chart. Look at the picture below to see what I mean. The reason is that nobody likes big steps in down trending market and these big steps are margin funding interest rate killers. Once the big step occurs, you can be sure that margin funding interest rate will not climb above this level for a long time and hence, offers placed above it won't be taken. So if you want your offers to be taken quickly, always place them below all big steps.

III. Rules to follow when margin funding rate is stable

When margin funding rate is in consolidation state, most of the time it fluctuates in a certain interval. In these conditions, the lending strategy is somewhat in the middle of the two mentioned above. In this case, I place my offers for a 10 to 15 days and the interest rate I choose by following 35K rule.

Conclusion

To conclude, I just want to say that Bitfinex margin funding is so far one of the best and easy to use tools for increasing your capital without much effort. Start investing by following the rules described above and I am sure that in time you will develop your own investment strategy. If you'll do (or maybe you already have one), then write your comment under this blogpost and share your thoughts with me and all the readers.